Introduction:

Inheritance Tax (IHT) receipts in the UK have been steadily increasing over the past decade, reaching record highs in recent years. Understanding these trends is essential for anyone involved in estate planning or interested in the evolving landscape of UK taxation.

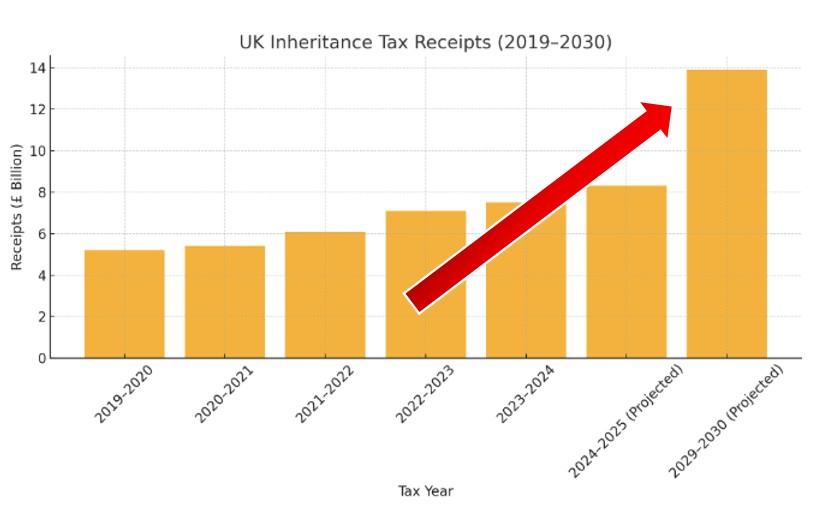

Rising IHT Receipts:

Recent data shows a clear upward trajectory for IHT receipts. From £3.8 billion in 2014–15, the total IHT take climbed to £8.2 billion in 2024–25. Between April and August 2025 alone, receipts reached £3.7 billion, marking a 5.7% increase compared to the same period in 2024. The Office for Budget Responsibility projects that by 2029–30, IHT receipts could surpass £13.9 billion annually.

Factors Driving the Increase:

- Frozen Tax Thresholds: The nil-rate band (£325,000) and residence nil-rate band (£175,000) have remained unchanged for several years. Inflation and rising property values mean more estates are now liable for IHT.

- Rising Asset Values: Increases in property, shares, and other assets have raised the taxable base of estates, bringing more into the IHT net.

- Policy Changes: Upcoming reforms, such as including unspent inherited pension pots in taxable estates from April 2027, are expected to further increase receipts.

- Timing Effects: There is often a lag between when an estate becomes liable for IHT and when the tax is collected, causing occasional spikes in receipts.

Implications for Estate Planning:

- More middle-value estates may now be liable for IHT, even if previously considered exempt.

- Effective estate planning, including gifting, trusts, and utilizing available reliefs, is increasingly important.

- Awareness of upcoming policy changes can help individuals better prepare for potential tax liabilities.

Conclusion:

UK Inheritance Tax receipts are on the rise due to a combination of frozen thresholds, rising asset values, policy changes, and timing effects. Staying informed and proactive with estate planning is crucial to mitigate potential tax burdens.

References:

Recent Comments